The GST Council has recently recommended an extension for the amnesty schemes, which had previously expired on June 30, 2023. This extension is now valid until August 31, 2023. The purpose of the amnesty scheme is to provide relief to taxpayers who have not filed various GST returns, including GSTR-4, GSTR-9 and GSTR-10. Additionally, it covers the regularization of orders related to the revocation of cancelled registrations and deemed withdrawal of assessment orders issued under Section 62.

To implement these recommendations, the Central Board of Indirect Taxes and Customs (CBIC) has issued several notifications on July 17, 2023. Let’s understand the details of each notification:

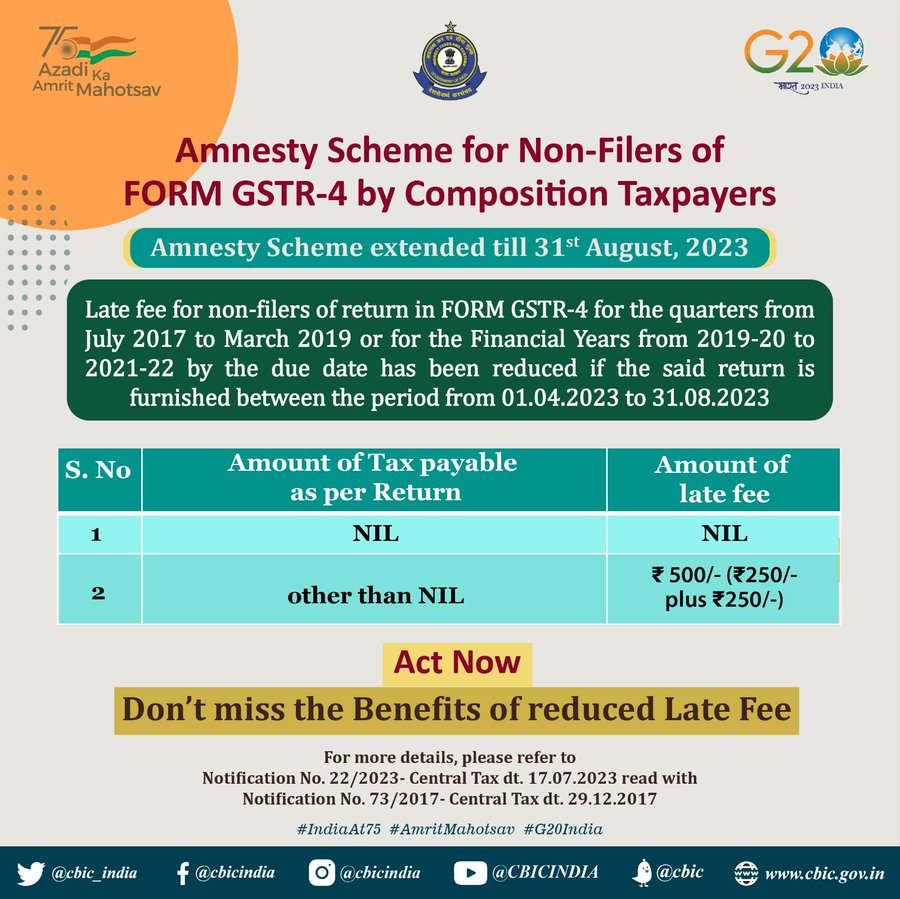

Extension of Amnesty Scheme for Non-Filers of GSTR-4

The deadline for non-filers of GSTR-4 has been extended from 30th June to 31st August, 2023 under the amnesty scheme, vide Central Tax Notification 22/2023. This extension provides taxpayers with more time to fulfill their filing obligations under the amnesty scheme. It is crucial for those who have not yet submitted their GSTR-4 returns to take advantage of this extended deadline and comply with the requirements.

CBIC Central Tax Notification 22/2023 dated 17/07/2023: Extension of Amnesty Scheme for Non-Filers of GSTR-4

CBIC’s GSTR-4 Amnesty Scheme 2023: Relief for Pending Returns

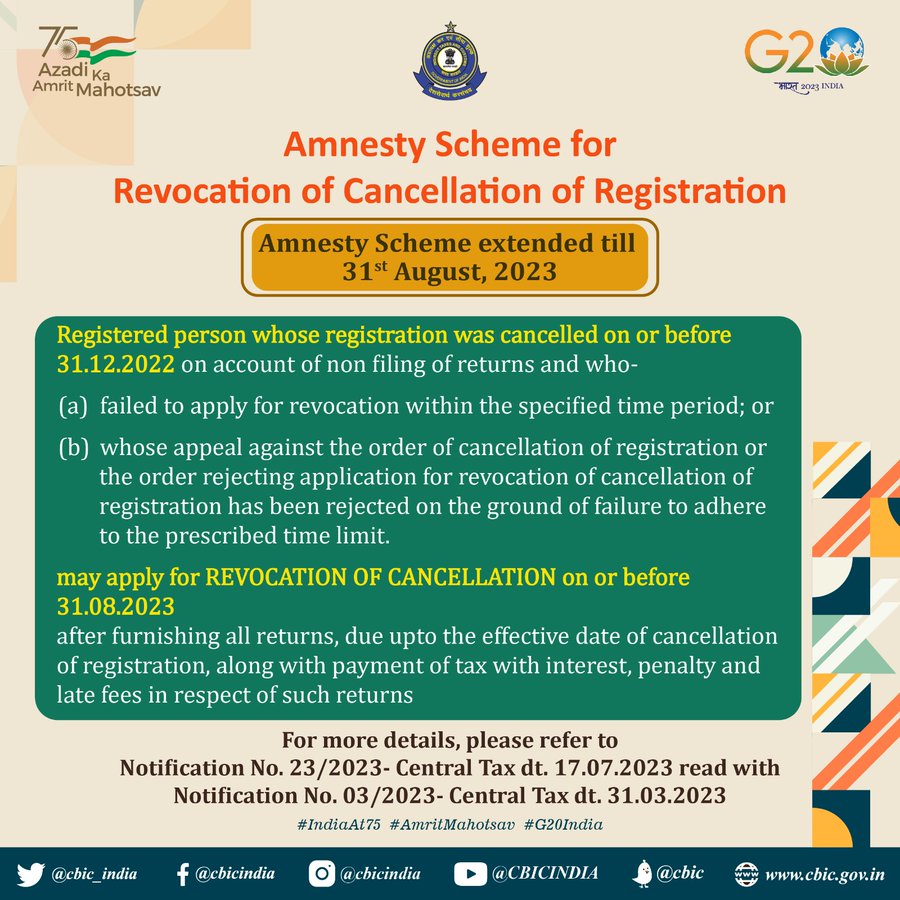

Time Limit Extension for Revocation of Cancellation of Registration under Amnesty Scheme

The time limit for applying for the revocation of cancelled registration under the amnesty scheme has also been extended from 30th June to 31st August, 2023, vide Central Tax Notificcation 23/2023. This extension allows businesses that had their registrations cancelled to regularize their status by applying for revocation within the extended timeframe. It is important for affected businesses to utilize this opportunity to rectify their registration status and ensure compliance.

CBIC Central Tax Notification 23/2023 dated 17/07/2023: Time Limit Extension for Revocation of Cancellation of Registration under Amnesty Scheme

CBIC’s Amnesty Scheme to Revoke GST Registration Cancellation

Extension of Amnesty Scheme for Deemed Withdrawal of Assessment Orders

The amnesty scheme provides relief for taxpayers who have received assessment orders u/s 62 of the CGST Act, by allowing them to have their orders deemed withdrawn. The deadline for availing this benefit has now been extended from 30th June to 31st August 2023, vide Central Tax Notification 24/2023. It is essential for those who fall under this category to take advantage of the extended deadline and take the necessary steps to rectify their assessment orders.

CBIC Central Tax Notification 24/2023 dated 17/07/2023: Extension of Amnesty Scheme Deadline for Deemed Withdrawal of Assessment Orders

CBIC Amnesty Scheme for Withdrawal of Best Judgement Assessement Orders

Extension of Deadline under Amnesty Scheme for Non-Filers of GSTR-9/9C

For taxpayers who have not filed their GSTR-9/9C returns, this extension in deadline of amnesty scheme provides an opportunity to rectify this non-compliance. The deadline for availing the benefits of the amnesty scheme for non-filers of GSTR-9 has been extended from June 30 to August 31, 2023, vide Central Tax Notification 25/2023. It is crucial for non-filers of GST annual return to utilize this extension and fulfill their filing obligations to avoid any penalties or legal consequences.

CBIC Central Tax Notification 25/2023 dated 17/07/2023: Extension of Deadline under Amnesty Scheme for Non-Filers of Annual Rteurn in GSTR-9/9C

GSTR-9/9C Late Fee Amnesty upto FY 2021-22 and Reduction from FY 2022-23

Extension of Deadline under Amnesty Scheme for Non-Filers of GSTR-10

This amnesty scheme caters to taxpayers who have not filed their GSTR-10 final return. The deadline for non-filers of GSTR-10 has been extended from 30th June to 31st August, 2023 vide Central Tax Notification 26/2023, providing them with additional time to rectify their non-compliance. It is imperative for those who have not yet submitted their GSTR-10 returns to make use of this extended deadline and fulfill their filing requirements.

CBIC Central Tax Notification 26/2023 dated 17/07/2023: Extension of Deadline under Amnesty Scheme for Non-Filers of GSTR-10 Final Return

GSTR-10 Final Return Late Fee Amnesty Scheme

Conclusion

These extensions for the GST amnesty schemes, aim to alleviate the burden on non-filers and provide them with an extended opportunity to rectify their non-compliance. It is important for taxpayers falling under any of the above-mentioned categories to promptly act and ensure compliance within the extended deadline of August 31, 2023. Failure to do so may result in penalties and other legal implications as usual.

|

Disclaimer: While reasonable efforts have been made to ensure the accuracy and reliability of the information presented in this article, it should not be considered as professional advice or guidance. For compliance, the readers are advised to directly refer to the relevant laws, regulations and notifications issued by the appropriate authorities. |

CA Abhinav Aggarwal is a qualified Chartered Accountant and ICAI member since 2010. He holds vast experience in Audit, Income Tax & GST and is a passionate writer on the CA profession and related topics.

CA Abhinav Aggarwal is a qualified Chartered Accountant and ICAI member since 2010. He holds vast experience in Audit, Income Tax & GST and is a passionate writer on the CA profession and related topics.

Upto which tax period, the assessment orders got amensty?

It’s about best judgment assessment orders issued on or before February 28, 2023, under Section 62(1) of the CGST Act, 2017. Nothing to do with tax periods.

Monthly late fee tax filers are also eligible?

Only few days left in extended deadline of 31st August, 2023. Is there any possibility of further extension of deadline for different GST amnesty schemes?

Please confirm whether there is any possibility of further extension of 31/08/2023 deadline for different GST amnesty schemes?

Whether government is planning to further extend GST AMNESTY SCHEMES?